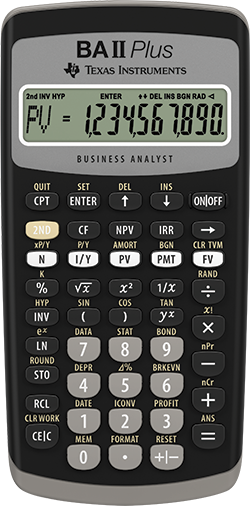

BA II Plus™ calculator

Designed for business professionals and students, this easy-to-use financial calculator delivers powerful computation functions and memory.

Designed for business professionals and students, this easy-to-use financial calculator delivers powerful computation functions and memory.

iOS is a trademark of Apple Inc., registered in the U.S. and other countries.

*Chartered Financial Analyst® is a trademark owned by CFA Institute.

†GARP® and FRM® are trademarks owned by Global Association of Risk Professionals, Inc.

‡CMA® is a registered trademark of the Institute of Certified Management Accountants, Inc.

None are affiliated with or endorse TI products.