Calculating Time Value of Money (TVM)

Calculating Time Value of Money

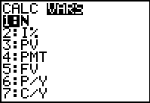

Use time-value-of-money (TVM) functions (menu items 2 through 6) to analyze financial instruments such as annuities, loans, mortgages, leases, and savings.

Each TVM function takes zero to six arguments, which must be real numbers. The values that you specify as arguments for TVM functions are not stored to the TVM variables.

Note: To store a value to a TVM variable, use the TVM Solver or use ¿ and any TVM variable on the FINANCE VARS menu.

If you enter less than six arguments, the graphing calculator substitutes a previously stored TVM variable value for each unspecified argument.

If you enter any arguments with a TVM function, you must place the argument or arguments in parentheses.

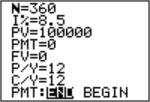

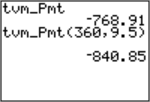

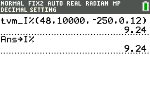

tvm_Pmt

tvm_Pmt computes the amount of each payment.

tvm_Pmt[(òÚ,¾æ,PV,FV,P/Y,C/Y)]

|

|

|

Note: In the example above, the values are stored to the TVM variables in the TVM Solver. The payment (tvm_Pmt) is computed on the home screen using the values in the TVM Solver. Next, the interest rate is changed to 9.5 to illustrate the effect on the payment amount.

tvm_I%

tvm_æ computes the annual interest rate.

tvm_¾æ [(Ú,PV,PMT,FV,P/Y,C/Y)]

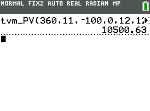

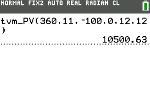

tvm_PV

tvm_PV computes the present value.

tvm_PV[(Ú,¾æ,PMT,FV,P/Y,C/Y)]

|

|

|

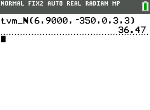

tvm_N

tvm_Ú computes the number of payment periods.

tvm_Ú[(æ¾,PV,PMT,FV,P/Y,C/Y)]

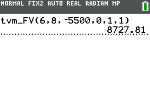

tvm_FV

tvm_FV computes the future value.

tvm_FV[(Ú,¾æ,PV,PMT,P/Y,C/Y)]