Calculating Cash Flows

Calculating a Cash Flow

Use the cash flow functions (menu items 7 and 8) to analyze the value of money over equal time periods. You can enter unequal cash flows, which can be cash inflows or outflows. The syntax descriptions for npv( and irr( use these arguments.

| • | interest rate is the rate by which to discount the cash flows (the cost of money) over one period. |

| • | CF0 is the initial cash flow at time 0; it must be a real number. |

| • | CFList is a list of cash flow amounts after the initial cash flow CF0. |

| • | CFFreq is a list in which each element specifies the frequency of occurrence for a grouped (consecutive) cash flow amount, which is the corresponding element of CFList. The default is 1; if you enter values, they must be positive integers < 10,000. |

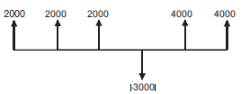

For example, express this uneven cash flow in lists.

CF0 = 2000

CFList = {2000,L3000,4000}

CFFreq = {2,1,2}

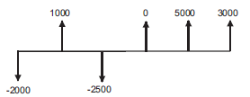

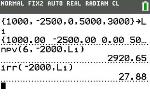

npv(, irr(

npv( (net present value) is the sum of the present values for the cash inflows and outflows. A positive result for npv indicates a profitable investment.

npv(interest rate,CF0,CFList[,CFFreq])

irr( (internal rate of return) is the interest rate at which the net present value of the cash flows is equal to zero.

irr(CF0,CFList[,CFFreq])

Classic