Example: Computing Present Value in Annuities

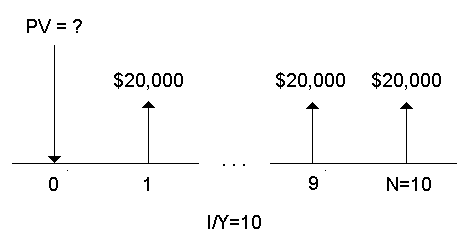

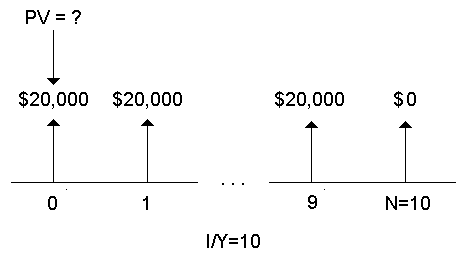

The Furros Company purchased equipment providing an annual savings of $20,000 over 10 years. Assuming an annual discount rate of 10%, what is the present value of the savings using an ordinary annuity and an annuity due?

Cost Savings for a Present-Value Ordinary Annuity

Cost Savings for a Present-Value Annuity Due in a Leasing Agreement

|

To |

Press |

|

Display |

|

Set all variables to defaults |

& } ! |

RST |

0.00 |

|

Enter number of payments |

10 , |

N= |

10.001 |

|

Enter interest rate per payment period |

10 - |

I/Y= |

10.001 |

|

Enter payment |

20000 S / |

PMT= |

-20,000.001 |

|

Compute present value (ordinary annuity) |

C . |

PV= |

122,891.347 |

|

Set beginning-of-period payments |

& ] & V |

BGN |

|

|

Return to calculator mode |

& U |

|

0.00 |

|

Compute present value (annuity due) |

C . |

PV= |

135,180.487 |

Answer: The present value of the savings is $122,891.34 with an ordinary annuity and $135,180.48 with an annuity due.