Example: Solving for Unequal Cash Flows

These examples show you how to enter and edit unequal cash-flow data to calculate:

| • | Net present value (NPV) |

| • | Internal rate of return (IRR) |

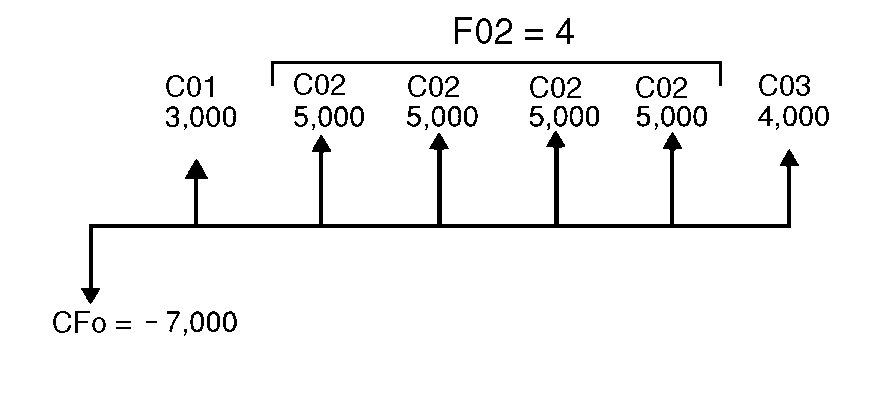

A company pays $7,000 for a new machine, plans a 20% annual return on the investment, and expects these annual cash flows over the next six years:

|

Year |

Cash Flow Number |

Cash Flow Estimate |

|

Purchase |

CFo |

-$7,000 |

|

1 |

C01 |

3,000 |

|

2–5 |

C02 |

5,000 each year |

|

6 |

C03 |

4,000 |

As the time line shows, the cash flows are a combination of equal and unequal values. As an outflow, the initial cash flow (CFo) appears as a negative value.

Entering Cash-Flow Data

|

To |

Press |

|

Display |

|

' |

CFo= |

0.00 |

|

|

Enter initial cash flow. |

7000 S! |

CFo= |

-7,000.001

|

|

Enter cash flow for first year. |

# 3000 ! |

C01= |

3,000.001 |

|

Enter cash flows for years two through five. |

# 5000 ! |

C02= |

5,000.001 4.001 |

|

Enter cash flow for sixth year. |

# 4000 ! |

C03= |

4,000.001 1.001 |

Editing Cash-Flow Data

After entering the cash-flow data, you learn that the $4,000 cash-flow value should occur in the second year instead of the sixth. To edit, delete the $4,000 value for year 6 and insert it for year 2.

|

To |

Press |

Display |

|

|

Move to third cash flow. |

" |

C03= |

4,000.001 |

|

Delete third cash flow. |

& W |

C03= |

0.00 |

|

Move to second cash flow. |

" " |

C02= |

5,000.001 |

|

Insert new second cash flow. |

& X 4000 ! # |

C02= |

4,000.001 |

|

Move to next cash flow to verify data. |

# |

C03= |

5,000.001 |

Computing NPV

Use an interest rate per period (I) of 20%.

|

To |

Press |

Display |

|

|

Access interest rate variable |

( |

I= |

0.00 |

|

Enter interest rate per period. |

20 ! |

I= |

20.001 |

|

Compute net present value. |

# C |

NPV= |

7,266.447

|

Answers: NPV is $7,266.44.

Computing IRR

|

To |

Press |

Display |

|

|

Access IRR. |

) |

IRR= |

0.00 |

|

Compute internal rate of return. |

C |

IRR= |

52.717 |

Answer: IRR is 52.71%.